Is it better to rent or own your home?

If you want to save money, renting is definitely the best choice. Today almost 32% of the households in America are renters. Instead of paying for upkeep and maintenance, they get to rely on the landlord to keep things running smoothly.

However, before you can get your foot in the door, you’ll have to get accepted to sign the lease. Are you moving and now you need to learn how to provide proof of income for your new apartment building? If yes, we can help!

Read on to learn how to provide proof of employment the easy way.

How to Provide Proof of Income

The first step in learning how to provide proof of income is to figure out what documents will work best for your situation. Here’s a list of eligible documents to prove your income:

- Tax returns

- Bank statements

- Social Security benefits Statement

- Proof of income letter

- Letter from your employer

- Pay stubs

- Annuity statement

- Pension distribution statement

- Unemployment benefits

- Worker compensation documentation

- Court-ordered Financial agreements

Keep in mind that workers’ compensation and unemployment benefits will only be able to prove your temporary income. While the apartment complex may accept these documents, they’ll likely require you to follow up with an additional proof of income when the benefits stop.

What Information Does Your Landlord Need?

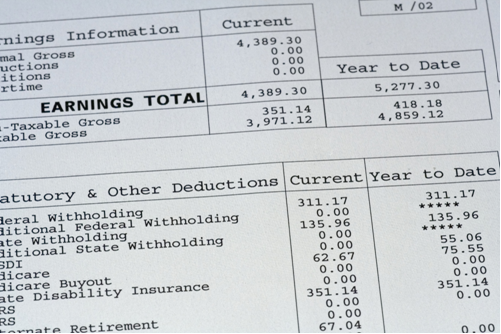

Now that you know a few of the different documents that can help you prove your income, let’s review the information these documents need to. First, when you verifying your income you’ll need the documents to include your name.

Next, list your total earnings, and payment dates. Moving on, the document should include either your employer’s name or the name of your company if you’re self-employed. Finally, official documentation should also include your social security number.

Tips for Self Employed Renters

Are you wondering how to show proof of income as a self-employed individual? As a freelancer, your tax records should be your go-to documents. One of the best things about using tax documents is that they’ll provide an annual reporting of your total income.

We also find that it’s helpful if you create your pay stubs. You can then provide your landlord with your annual pay stub records to show your total earnings for the year. The best part is, you don’t need an accountant are inexpensive software program to make your pay stub.

Can you create a pay stub for free online? Yes, you can! Having digital records of your payment will also make it easier to do your taxes when the time comes.

Sign Your Lease

Now you know how to provide proof of income when you’re applying for an apartment. What method are you going to use?

Do you plan on printing out your bank statements? Or are you going to use pay stubs and tax documents?

Whatever approach you take, we hope our article will help you sign your lease as soon as possible. For more helpful tips like the ones in this article, check out the rest of our site.